New sector report: lack of skilled workers the new sticking point

Three megatrends are currently influencing the German lift sector: digitalisation, sustainability and demographic change. This was revealed by the new sector report about the German lift and escalator sector, which has just been published.

The author is once again Dr Jürgen Dispan. The LIFTjournal is publishing a slightly abbreviated summary.

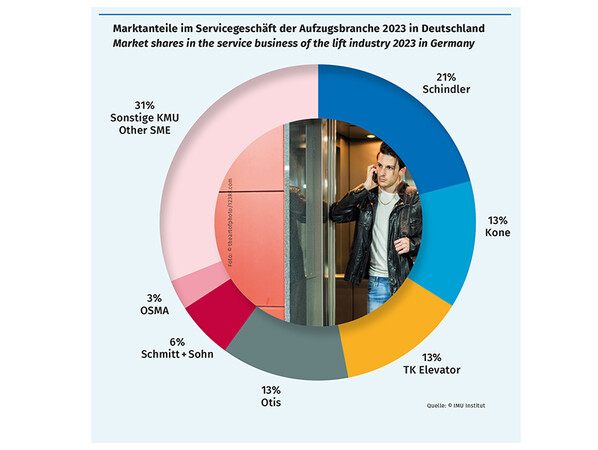

The lift and escalator sector has about 22,000 employees. The core area of the sector in Germany has undergone a major change in a long-term process from production towards service. Most companies today concentrate on service business with maintenance, repair and spare parts along with the sale and assembly of new installations and modernisation. For the production of lifts and escalators and their components there are now European or worldwide value chain concepts and this only still occurs in a few domestic plants.

For some decades, the sector’s peculiarities have included a very strong service orientation, concentration processes among companies, international value chain strategies, the expansion of atypical employment forms (subcontracting) in new installation construction and the modernisation business, performance optimisation and increased work supervision, especially for the fitters (with special workload due to field work) and standards and guidelines as drivers of innovation.

Three megatrends

Download: Here you can download the complete sector report for free. In the 2020s, the three megatrends of digitalisation, sustainability and demographic change will have a decisive effect on sector development and company strategies. Digitalisation in particular could become a game changer for the lift and escalator sector as such and in particular for the working world in the sector.

Not least since the Corona pandemic, digital transformation has once again undergone an enormous acceleration, particularly as far as the work processes in all areas are concerned. Digital services, new business models, artificial intelligence, data analysis and the "Internet of lifts" will fundamentally change the sector as such and work in the sector. The working conditions for those involved in field service, which will further change as a result of digital tools, play a special role here.

For example, specific digitalisation approaches in the lift sector exist in the digital platforms for condition monitoring and predictive maintenance, sensory and cloud solutions with data evaluation and digital features for lift operators, apps, additional functions for the passenger experience and integration of the product "lift" in the networked system of building technology.

Sustainability and shortage of skilled labour

Sustainability, decarbonisation, green balance sheets, CO2 footprint, resource efficiency and recycling will become indispensable with regard to global challenges as well as on account of legal and customer requirements.

Demographic change and the associated shortage of skilled labour presents all lift sector companies with great challenges, especially when it comes to recruiting service fitters, technicians and digitalisation specialists as well as in the fields of education and further training.

The major structural challenges for the lift and escalator sector are linked to these megatrends of digitalisation, sustainability and demographics. On top of these are the current challenges, which are primarily to be found in supply bottlenecks, shortage of materials and steep price increases for purchased parts and components.

Pressure to perform and work intensification

Photo: © DeanDrobot/IMU Institut/iStock.com

Photo: © DeanDrobot/IMU Institut/iStock.comThe experts surveyed assessed the shortage of skilled labour and new recruits as the most pressing factors with regard to the challenges and sticking points for companies in the lift and escalator sector. The supply and material bottlenecks and resulting price increases were mentioned as further limiting factors.

Almost all members of works councils surveyed mentioned the working conditions in the office and in field service, which were increasingly marked by pressure to perform, work intensification and psychological burdens as another sticking point along with deficits or needs for improvement in strategic personnel planning.

Another challenge mentioned with almost equal frequency was curbing the award of orders to subcontractors and reinforcing inhouse production. But how do the experts surveyed assess the future prospects of the lift and escalator sector in Germany?

Good economic prospects

At the end of the expert interview, those surveyed provided their assessment of the prospects for the sector with regard to the economic and employment development up to 2030: the economic prospects were universally regarded as good to very good because many general development trends were "playing into the hands" of the sector.

A more differentiated picture arose with regard to estimates of the employment prospects in 2030 in Germany. Most expect more or less of a reduction in workplaces in quantitative terms; some of the surveyed experts assumed a lateral movement, i.e. a compensation of negative workplace effects (e.g. as a result of predictive maintenance concepts and remote services) through a growth in modernisation, new lifts and "lifts-in-service".

Experts expect a decline in employment for administrative positions. The standardisation of processes favours the centralisation of work as well as the outsourcing and offshoring of administrative work. However, new opportunities for employment would also arise with an increase in digitalisation. New job profiles would play a role and there would be growth areas in employment, such as specialists for software, programming, data analysis or artificial intelligence.

Polarisation in field service

Photo: © theartofphoto/IMU Institut/123RF.com

Photo: © theartofphoto/IMU Institut/123RF.comAlmost all of the experts surveyed expected differentiation or polarisation in field service work in the coming years in qualitative terms. While jobs would disappear in the case of classic route fitters, the gulf between technical specialists on the one hand and fitters for simple maintenance tasks on the other side would widen in terms of qualification, work conditions and payment.

Overall, the long-term success and future viability of the lift sector would depend heavily on well-trained and motivated employees. The competences and qualifications of the employees, company training and further education, the quality of the work and working conditions, participation and codetermination opportunities and an innovation-friendly corporate culture would be decisive.

The bundling of these subjects in a forward-looking strategic personnel policy is a decisive configuration field for the future viability of companies in the lift and escalator sector and as a result for all of mechanical engineering. You can download the complete 2023 sector report online.

More informations: imu-institut.de and boeckler.de

Background: The IMU sector report is published by the Hans Böckler Foundation and IG Metall. The last sector report was published in 2015. Expert interviews were conducted in companies (with members of works councils and managers), sector leaders of the IG Metal and managing directors/chairman of the VDMA (Lifts and Escalators Trade Association) VFA Interlift and VmA).

In addition, the author Dr Jürgen Dispan collected information from talks at the interlift 2022, the E2 Forum and sector conferences for lifts and escalators of the IG Metall. Apart from literature evaluation and document analysis, statistical data on the economic development of the VDMA and VFA as well as personal surveys on employment and company structure were used.

The over 22,000 employees are distributed as follows:

• Big 4 (incl. subsidiaries) 14,000

• Large medium-sized companies 2,300

• Lift SMEs 6,000

Write a comment